Chinese LFP Batteries Maintain Cost Advantage Despite US Tariff Increases

Published: 7.10.2024

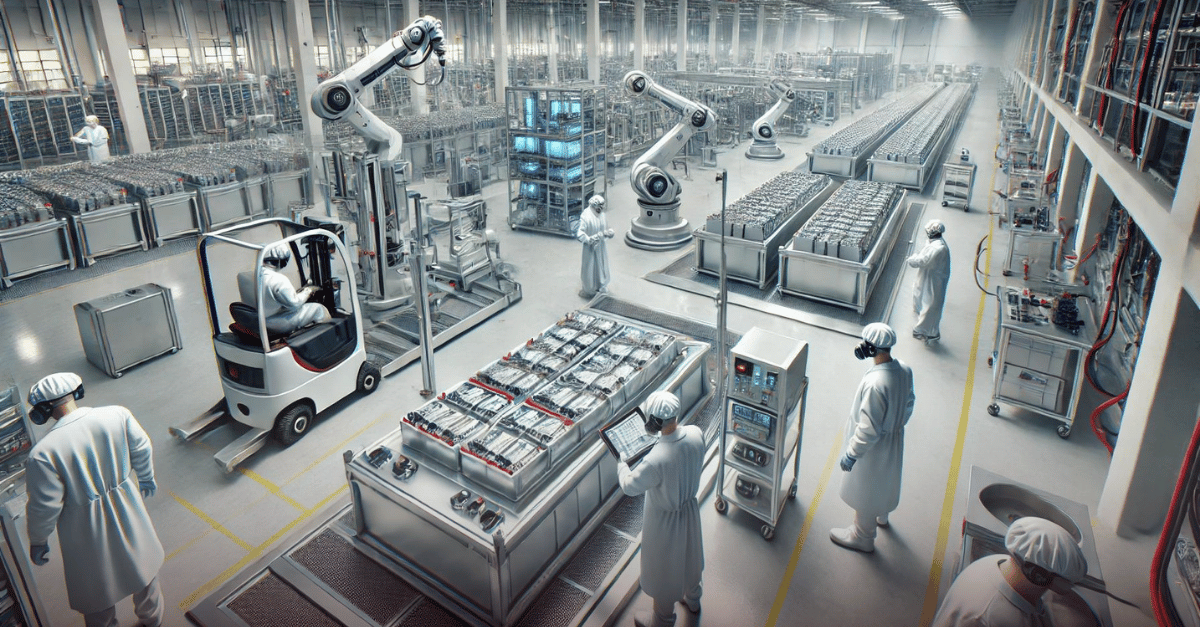

In a recent report by TrendForce, it has been highlighted that despite the significant tariff increases imposed by the United States, Chinese lithium iron phosphate (LFP) batteries continue to hold a substantial cost advantage over their American counterparts. This development has major implications for the electric vehicle market and the broader battery manufacturing industry.

On May 14, 2024, the White House announced significant tariff increases on Chinese electric vehicles and batteries. The tariffs on EVs have surged from 25% to 100%, while battery tariffs have risen from 7.5% to 25%. These measures are part of an ongoing effort to pressure the Chinese battery market and reduce dependency on Chinese suppliers.

However, TrendForce research indicates that the cost of Chinese LFP batteries remains lower than that of US-manufactured ones—even with the increased tariffs. US-manufactured batteries are more than double the price of Chinese ones, which presents a significant challenge for US automakers striving to keep EV production costs competitive.

The increased tariffs are expected to raise EV production costs for US manufacturers, complicating efforts to reduce overall vehicle costs and incentivize consumer purchases. This comes when US automakers are under pressure to scale up EV sales to achieve economies of scale and reduce battery costs.

Some US companies have already started to respond to this need. Tesla has established an LFP battery production line at its Sparks, Nevada factory, with an estimated capacity of 10 GWh, which is sufficient for approximately 130,000 vehicles with 75 kWh batteries. LG Energy Solution is also setting up an LFP production line in Arizona, slated for mass production by 2026.

Additionally, other companies such as Gotion, American Battery Factory Inc., FREYR Battery, and Our Next Energy are planning to establish LFP production lines, although these batteries are expected to be primarily used in energy storage systems (ESS) rather than exclusively in the EV sector.

The increased tariffs and the evolving regulations underscore the growing geopolitical influence on the EV industry. Traditional US automakers must decide whether to focus their resources on fuel vehicles or EVs to avoid misallocation of resources. The example of BYD, which ceased production of fuel vehicles and quickly surpassed Tesla in sales, demonstrates the potential benefits of a clear strategic focus on EVs.

While the US is making strides towards reducing its reliance on Chinese battery suppliers, the road ahead is complex and requires significant investment and strategic partnerships. The cost advantage of Chinese LFP batteries remains a formidable challenge that US manufacturers must navigate in the evolving landscape of the global EV market.

.png)